What is Health Insurance?

Health Insurance or medical insurance is a contract between the insurer and policyholder where the insurance company offers medical coverage to the insured up to the sum insured limit. Multiple benefits on health plans are available, like coverage for pre & post hospitalization, medical check-ups, room rent coverage, cashless facility, etc.

Benefits of Buying Health Insurance Plans Online?

Buying a health insurance policy online comes with several benefits. Take a look at them below:

- Easier to Compare Plans – It is easier to compare health insurance plans from different insurers online at websites like Policybazaar.com to make an informed decision.

- More Convenient – It is more convenient to buy the policy online as you do not have to visit the branch of the insurance company or take an appointment to meet an insurance agent.

- Online Discounts – It allows you to avail discount on premiums for buying the policy online.

- Lower Premiums – Health plans are available for a lower premium online as insurance companies save a lot on operational costs.

- Minimal Paperwork – The process of buying a health insurance policy online involves minimum to zero paperwork.

- Policy Available 24x7 – A health insurance policy can be purchased online any time of the day, even on public holidays, which is not possible in offline buying.

- Digital Payment Options – It allows you to avoid cash payments and use digital payments methods to pay the premium online safely.

- Instant Policy Purchase – A health insurance policy is issued instantly when purchased online unlike offline buying.

- Time-saving – It saves you a lot of time as the policy is issued within a few minutes of buying.

Health Insurance Buying Checklist

Waiting Period

Co-payment

Preventive Health Check-up

Grace Period

Restore Benefits

No Claim Bonus

Sub-limits

Network Hospitals

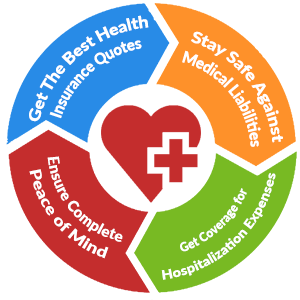

Top Reasons to Buy a Health Insurance Plan

Medical inflation is increasing every day making treatments expensive. If you get hospitalized for a critical illness or lifestyle disease, you may end up losing all your savings. The only way to afford quality medical treatment during a health emergency is by buying a health insurance policy. Take a look at some of the top reasons to buy a health insurance plan below:

- Beat Medical Inflation - A health insurance policy can help you pay your medical bills, including pre and post-hospitalization expenses, today as well as in future despite the rising medical costs.

- Afford Quality Medical Treatment - It helps you to afford the best quality medical treatment and care so that you can focus only on getting cured.

- Fight Lifestyle Diseases - It allows you to pay for the long-term treatment of lifestyle diseases like cancer, heart attack, etc. that have been on the rise with the changing lifestyles.

- Protect Your Savings - It helps you to protect your hard-earned savings by covering your medical expenses so that you can avail the required treatment without any financial worries.

- Avail Cashless Hospitalization Facility - It allows you to obtain a cashless hospitalization facility at any of the network hospitals of your insurance provider by raising a cashless claim.

- Get Tax Benefits - It enables you to save tax on the health insurance premium that you’ve paid under section 80D of the Income Tax Act for better financial planning.

- Ensure Peace of Mind - It allows you to obtain medical treatment with peace of mind as you do not have to worry about paying the hefty hospital bills.

Key Benefits of Health Insurance Plans in India

Health insurance plans offer a variety of health benefits to the insured depending on the plan. Following are the key benefits of buying a health insurance plan in India:

- Hospitalization Expenses - A health insurance plan covers the medical expenses incurred on getting admitted to a hospital for more than 24 hours. It includes room rent, doctor’s fee, medicine cost, diagnostic test fees, etc.

- Pre & Post Hospitalization Expenses - It covers the medical expenses that you may have incurred on an illness before getting hospitalized as well as follow-up treatment expenses incurred after getting discharged. The pre-hospitalization and post-hospitalization expenses are covered up to a fixed number of days as specified in the policy document.

- ICU Charges - A health insurance plan also covers the cost of availing treatment in an ICU during hospitalization.

- Ambulance Cost - It covers the cost of ambulance services availed to reach the nearest hospital during a medical emergency.

- Cashless Treatments - All health insurance providers in India offer cashless treatment facilities at their network hospitals. You do not have to worry about arranging money to pay the hospital bills if you get admitted to a network hospital as it will be settled by your insurer under cashless claims.

- Day Care Procedures - It also covers the cost of availing day care treatment that requires hospitalization for less than 24 hours.

- Pre-existing Diseases - The best health insurance policy also provides coverage for pre-existing diseases after you have completed the waiting period. Usually, pre-existing diseases are covered after a waiting period of 2 to 4 years.

- AYUSH Treatment - It covers the cost of availing medical treatment through AYUSH school of medicines that includes Ayurveda, Unani, Homeopathy, Siddha and Yoga.

- Medical Check-ups - Most health insurance companies in india offer free preventive health check-up facilities to the insured at regular intervals depending on the policy terms and conditions.

Best Health Insurance Plans in India

We at Policybazaar can help you to buy the best health insurance plan that suits your health requirements. Below is the list of health insurance plans offered by the top insurance companies in India. You can do an online comparison and find the best health plan for yourself.

Disclaimer : *Policybazaar does not endorse, rate or recommend any particular insurer or insurance product offered by an insurer.

Types of Health Insurance Plans

What is Covered in a Health Insurance Plan?

Most health insurance companies in India cover the following medical expenses under a health insurance policy:

- In-patient Hospitalization Expenses -The hospitalization expenses incurred during the treatment of an illness or injury are covered provided the hospitalization is for more than 24 hours.

- Pre-existing Illnesses or Diseases - After the completion of the waiting period, you can file a claim for the expenses incurred on the treatment of any pre-existing illness or condition.

- Pre and Post Hospitalization Expenses - Medical expenses incurred on blood tests, x-ray, and other medical check-ups that are required before hospitalization are taken care of by the insurance company. Similarly, the cost of medicines and preventive health check-ups that are done to ascertain your health after the discharge from the hospital is covered under the health insurance plan.

- Ambulance Charges - Although the coverage amount varies from insurer to insurer, most medical insurance plans cover emergency ambulance charges.

- Maternity Cover - Medical expenses incurred during the pregnancy and delivery are covered along with newborn baby expenses.

- Preventive Health Check-ups - Regular health check-up facilities are also made available in some health insurance plans in India.

- Day-care Procedures - Daycare treatments where hospitalization is not required for more than 24 hours are covered. It includes eye surgery, dialysis, and other common daycare surgeries as mentioned in your policy document.

- Home Treatment Cover - It also covers the expenses incurred on getting medical treatment at home on the advice of a medical practitioner.

- AYUSH Benefit - A health insurance plan also reimburses the medical costs incurred on Ayurveda, Unani, Siddha or Homeopathy treatment up to a specified limit.

- Mental Healthcare Cover – Several health plans in India offer coverage for the medical expenses incurred on the treatment of mental illness, like depression.

What is Not Covered in a Health Insurance Plan?

The following medical expenses and situations are not covered in a health insurance plan:

- Unless there is an accidental emergency, claims arising during the initial 30 days of buying a health insurance plan are not covered.

- Coverage of pre-existing diseases is subject to a waiting period of 2 to 4 years

- Critical illnesses coverage usually comes with 90 days waiting period

- Injuries caused by war/terrorism/ nuclear activity

- Self-inflicted injuries or suicide attempts

- Terminal illnesses, AIDS, and other diseases of similar nature

- Cosmetic/plastic surgery, replacement of hormones surgery, etc.

- Dental or eye surgery expenses

- Bed rest/hospitalization and rehabilitation, common illnesses, etc.

- Treatment/diagnostic tests and post-care procedures

- Claims arising out of adventure sports injuries

Note: It is recommended to check your policy wordings to get a detailed list of exclusions.

Key Factors to Consider before Buying a Health Insurance Plan

There are a few factors that you should consider closely to make the right decision while buying a health insurance plan:

- Check the Scope of Coverage -The policy coverage and the sum insured amount will decide the type of illnesses and surgeries that you can claim during the policy term. Closely look at the benefits offered like hospitalization expenses, daily cash benefit, COVID hospitalization cover, critical illness cover, maternity cover, etc. while choosing a health plan.

- Adequate Sum Insured - The sum insured amount is a crucial deciding factor in selecting a medical insurance policy. Looking at the ongoing inflation it is advisable to buy a health insurance plan with a minimum sum insured of Rs 10 lakh that can go up to Rs 1 crore. If it’s a family floater policy or senior citizen insurance, the higher the sum insured the better the coverage will be.

- Policy Type - There are different types of medical insurance policies that are available in India. As per your requirement, you can choose to buy individual health insurance, senior citizen health insurance, family floater or critical illness plans. Moreover, you can buy Top up and Super Top up health insurance along with your existing health plan to enhance the coverage. This is beneficial in case your base sum insured gets exhausted during the treatment. You can choose this option at the time of policy purchase and renewal.

- Waiting Period Clause - Your health insurance policy only comes into action once the initial waiting period is over. If any claim is filed during the initial waiting period except for accidental hospitalization claims, the insurer can reject it. Moreover, the waiting period clause also applies to pre-existing diseases like thyroid, blood pressure, diabetes, etc. It is also applicable to specific illnesses, treatments, and maternity cover. You can choose a plan with a minimal waiting period.

- Co-payment Clause - Your medical insurance policy may have a co-payment clause, which means a certain percentage of the claim amount should be borne by you (insured). The co-payment option does not have any effect on the sum insured. It allows you to reduce your premium to a certain extent but certainly increases your out-of-pocket expenses. Only opt for this clause if you can pay off a portion of your hospitalization bills, that can be 10% and above without a financial burden.

- Room Rent Sub-limits - A health insurance plan may have various sub-limits and the most common one is the room rent sub-limit. For instance, if your medical insurance policy comes with a sum insured of Rs 3 lakh with a sub-limit of 1%on daily room rent, then your room cost will be covered up to Rs 3,000 per day. Any additional amount on room rent will have to be paid from your own pocket. So, a health plan with no or minimal sub-limits is advisable.

- Network of Cashless Hospitals - Check the list of network hospitals for an insurance company where cashless claims can be filed. The maximum number of network hospitals you have in your vicinity,the better are the chances of availing cashless hospitalization benefits.

- Lifelong Renewability Option - Medical insurance policies are usually renewed every year. When the policy term is about to end, in order to continue the insurance coverage, the insured has to pay the insurance premium at the time of renewal. When buying a health insurance plan, choosing a plan with a lifetime renewal option is beneficial in the long run.

- Premium Loading Factor - Premium Loading is the additional amount that is charged to a risk-prone policyholder in the premium, especially in senior citizen health insurance plans. Choosing a medical insurance plan with no loading will save you from paying an extra premium. Some insurers also charge a claim loading. This aspect, though ignored in the beginning, usually increases your out-of-the-pocket expenses at the time of claim.

- Check the Claim Settlement Ratio - This is an important criterion to assess the credentials of an insurer. You should always go with a company with a good claim settlement record. A claim settlement ratio above 80% can be an ideal choice.